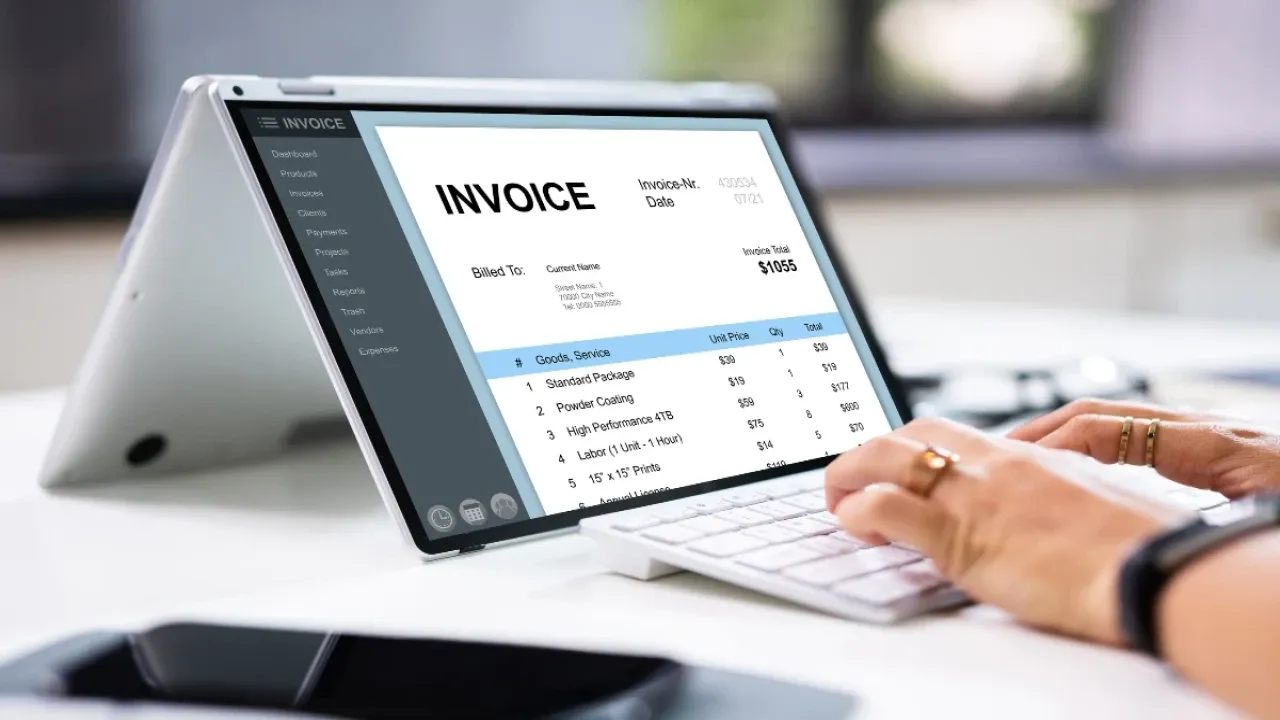

Invoice Financing

Running a business but stuck due to pending payments from clients? Invoice Financing from UGMoney Capital lets you unlock cash instantly against your unpaid invoices without waiting for your clients to clear dues.

This short-term borrowing option helps you improve your working capital, maintain cash flow, and meet day-to-day expenses like salaries, inventory, and operations. Instead of waiting 30, 60, or 90 days for your payments, you can submit your invoices to us, and we’ll finance up to 80–90% of the invoice value.

Our invoice finance service is ideal for startups, MSMEs, and established businesses that deal with B2B clients and face cash delays due to credit terms. This model not only improves your liquidity but also keeps your business operations smooth and scalable.

At UGMoney Capital, the process is completely secure, transparent, and fast. No need to pledge your assets — your invoice acts as the only security. Repayment is done when the client settles the invoice. It’s a smart, non-intrusive way of financing your business growth.

Invoice financing Requirements

To qualify for invoice financing, the business should have a valid client base with confirmed receivables. Here's what you need

- Registered business entity (Proprietorship, Partnership, or Pvt. Ltd.)

- Valid PAN, GST, and Aadhaar details

- Business bank account (minimum 6 months active)

- Invoices raised to reputable companies (B2B only)

Why choose letter of credit

- Improves business scalability and vendor confidence

- Supports payroll, rent, inventory, and supplier payments

- Supports payroll, rent, inventory, and supplier payments

- Keeps ownership and control of your business intact

- Reduces stress from long credit terms (30–90 days)

- Enhances vendor/supplier relationships through timely payments